Key takeaways

Managed transition for the North Sea

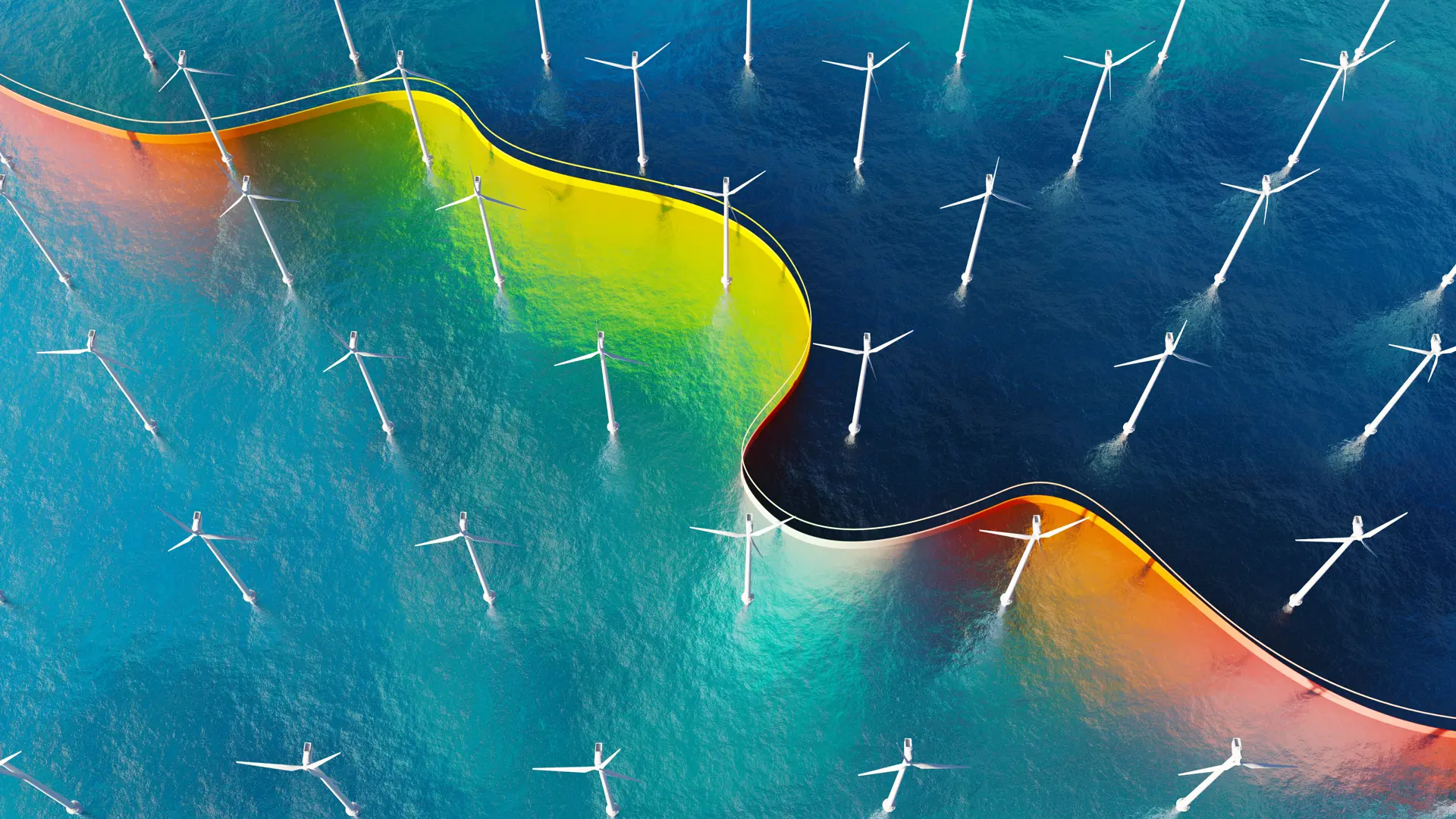

Existing oil and gas managed responsibly while clean energy grows.

End of new exploration, limited production

No new exploration; limited production tied to existing fields.

Workers and supply chains prioritised in the North East

Jobs, skills and supply chains central to long term transition.

On 26 November 2025, the UK Government published the North Sea Future Plan (the Plan), setting out its strategy to grow clean energy industries, manage existing oil and gas fields responsibly, and support North Sea workers and communities through the transition. This builds on the March–April 2025 consultation, Building the North Sea’s Energy Future.

With North Sea oil and gas output down by roughly 75% from its 1999 peak as of 2024, the government aims to place communities, workers, businesses, and supply chains at the heart of Britain’s clean energy and industrial future, supporting economic growth and energy security while meeting climate goals. Over the last decade, more than 70,000 jobs have been lost in the North Sea oil and gas sector, underlining the urgency of a managed transition.

The Plan introduces significant changes: ending new oil and gas exploration licences, creating Transitional Energy Certificates (TECs) to allow limited production linked to existing fields and infrastructure, establishing a minister-led North Sea Future Board, and delivering comprehensive workforce support through a new North Sea Jobs Service and the Energy Skills Passport. It also promises guidance and a basin-wide supply chain plan to give investors greater transparency over upcoming activity. Key updates are discussed below.

Licensing Policy and TECs

Although the government acknowledges that the North Sea will continue to power Britain for many decades to come through existing fields, it has decided to honour its manifesto commitment to cease issuing new licences for the exploration of new oil and gas fields. This ban applies to new offshore oil and gas licences as well as onshore licences in England.

Existing fields will be permitted to continue operating for the remainder of their productive life. However, the government acknowledges that the viability of such fields can be affected by the closure of neighbouring fields, which can increase the cost of shared infrastructure such as pipelines and processing facilities. To mitigate this risk, the government has introduced TECs.

TECs will grant the holder exclusivity over a specific area of the seabed adjacent to an existing licensed block where there is already a known hydrocarbon accumulation. That accumulation must be capable of being developed via a tieback to existing infrastructure. Projects supported by TECs must: (i) not involve any new exploration; (ii) connect to existing infrastructure; and (iii) be demonstrably necessary to support an orderly and prosperous transition.

TECs will be issued by the North Sea Transition Authority (NSTA) outside the annual licensing cycle. Further detailed guidance is expected to follow.

Workforce

The North Sea Jobs Service is intended to provide tailored, end-to-end support for the current workforce seeking new opportunities in growing industries across the government’s industrial strategy sectors. The service is intended to guide workers through each stage of their career journey, from identifying future roles to training and securing high-quality employment.

The service builds on the Energy Skills Passport that was launched in January 2025 to help oil and gas workers showcase their transferable skills to the offshore wind sector. This initiative has since been expanded to include nuclear and the electricity grid sectors, alongside £20 million of funding for bespoke careers training.

In addition, the government intends to introduce a new Fair Work Charter between offshore wind developers and trade unions. This is intended to ensure that companies benefiting from public funding deliver fair pay, good working conditions and strong workplace rights.

Together, these measures aim to convert the offshore workforce’s transferable skills into secure roles across offshore wind, carbon capture and storage (CCS), hydrogen, advanced manufacturing, defence, and adjacent sectors.

Supply chain guidance and investment certainty

Rystad Energy’s 2024 report on supply chain opportunities in the energy transition estimated that the UK oil and gas supply chain could deliver between 60-80% of the capabilities required for energy transition projects, including floating offshore wind, CCS, and hydrogen, through to 2040.

Against this background, the government has asked the NSTA to work with industry to introduce a five-year, basin-wide supply chain plan. This plan will be published alongside detailed guidance and is intended to provide suppliers with improved visibility of operator activity across offshore wind, CCS and hydrogen projects. It builds upon a similar plan that exists for decommissioning.

The aim is to provide greater clarity for supply chain participants on project sequencing to enable North East businesses to position themselves for framework agreements, alliances, and consortium bids, while planning the necessary capital investment, workforce development, and facility upgrades at ports and fabrication yards. This sits alongside the £700m investment committed by Great British Energy and The Crown Estate to support component manufacture, enable networks and build infrastructure.

Regulatory reform and oversight

The government intends to revise the NSTA’s principal objective so that it moves beyond a sole focus on maximising the economic recovery of UK Petroleum. The NSTA’s statutory objectives will be broadened to (i) maximise the overall societal economic value of a relevant activity; (ii) assist the government in achieving its net zero objectives; and (iii) enhance the long-term benefits of the transition to clean energy technologies in the UK Continental Shelf by considering the interests of workers, communities and supply chains.

As part of this reform, the NSTA’s oversight of decommissioning will be strengthened. This will include powers to impose enforceable well-decommissioning milestones and to take financial security where those milestones are not met, particularly in relation to older subsea wells drilled before 2009. The NSTA will also be allowed to retain the unspent part of the offshore levy through which it is funded rather than returning it.

In addition, the NSTA’s dispute resolution powers are also being made binding, its power to levy financial penalties is being increased from £1m to £5m (with potential to increase it to £10m in the future), and the NSTA is being given power to remove an offshore petroleum licence where it deems the holder is no longer deemed fit and proper. The NSTA will also be able to refuse consents where it considers a relevant person’s plans are not in line with its objectives.

A new minister-led delivery board, bringing together unions, industry, and regulators, will oversee the progress, coordination, and long-term planning of the North Sea’s industrial transition.

What this means for North East businesses

The Plan signals a major shift toward clean energy, but it also creates immediate and longer-term opportunities for businesses across the region. While oil and gas activity will gradually decline, near-field projects enabled by TECs may, in practice, unlock short-cycle work tied to existing hubs offering immediate prospects for operators and supply chain businesses. To capitalise on these, companies should begin auditing tie-back potential, pipeline capacity, and power-from-shore options while preparing for forthcoming NSTA guidance and application criteria. At the same time, workforce planning will be critical, mapping transferable skills, aligning training with roles in offshore wind, CCS, and hydrogen, and leveraging available funding and regional programmes.

Contracting strategies also need attention. Reviewing alliance contracting models, integrated EPC(I) arrangements, and decommissioning frameworks will help manage risk across multi-technology energy hubs. Businesses should also assess ports and infrastructure capacity to ensure readiness for the basin-wide supply chain plan, securing positions within OEM and Tier-1 frameworks through strategic investment.

Regulatory readiness is another priority. Companies must prepare for changes to NSTA objectives, ensure compliance with decommissioning obligations, and meet emissions reduction and environmental consent standards. Financing and incentives will play a key role, requiring careful structuring to meet UK content guidance and qualify for public co-funding and guarantees.

How we support these priorities

At Hill Dickinson, we understand the complexities of the North Sea’s evolving energy landscape and the challenges businesses face during this transition. Our role is to provide clear, practical guidance on regulatory changes, workforce planning and supply chain positioning, helping organisations stay informed and prepared.

We aim to support clients in identifying opportunities, managing risk and navigating the legal and commercial aspects of this shift. Whether it’s understanding new frameworks, planning for compliance or exploring strategic partnerships, our focus is on enabling businesses to adapt and thrive in a changing market.

With deep sector expertise, Hill Dickinson offers end-to-end legal support to help North East businesses seize opportunities and thrive in the UK’s evolving energy landscape.

This article was co-authored by trainee, Morgan MacWilliams.